As gold surged to an all-time high on Thursday, the world’s largest gold reserves came into the spotlight.

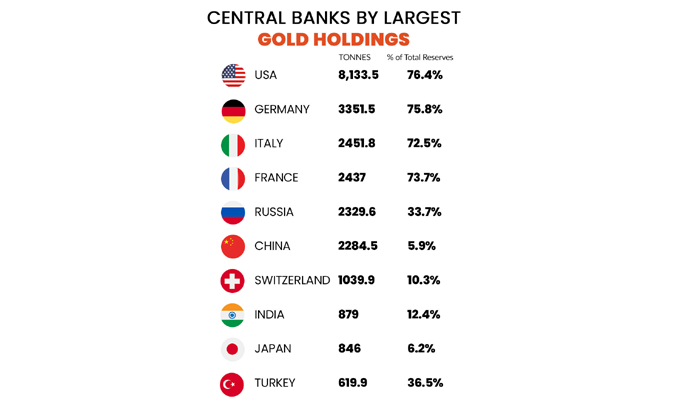

The United States, Germany, and Italy top the list of countries holding the most gold, reflecting the precious metal's continuing appeal amid ongoing geopolitical and economic uncertainty.

Gold has long been considered a safe-haven asset, and its role in central bank reserves continues to grow as tensions in global markets escalate. Central banks around the world view gold as a stable, liquid asset with strong return characteristics, making it a cornerstone of their reserve strategies. The demand for gold has increased significantly, driven by these buying patterns among central banks and investors seeking stability in times of economic volatility.

Top Gold Reserves

United States: With a commanding lead, the United States holds the largest gold reserves in the world, amounting to over 8,100 tonnes. This vast stockpile is part of the US’s strategy to maintain a strong and stable economic foundation, backed by one of the largest and most liquid financial markets in the world. The US has long been a key player in the gold market, using its gold reserves as a hedge against inflation and financial instability.

Germany: In second place, Germany holds around 3,355 tonnes of gold. The country’s gold reserves are seen as a symbol of its strong economy and prudent financial policies. Germany’s holdings are also crucial in maintaining the stability of the eurozone, where gold is considered a key asset in economic planning.

Italy: Italy rounds out the top three with more than 2,400 tonnes of gold reserves. As a member of the European Union, Italy’s gold stockpile serves to underpin the value of the euro and support the country’s financial stability.

Asia’s Dominance in Gold Reserves

While Western nations dominate the top spots, Asia is also home to some of the largest gold reserves. China and India stand out in particular for their growing gold holdings. China, the world’s second-largest economy, has been steadily increasing its gold reserves over the years, holding nearly 2,000 tonnes as of January 2025. This move is part of China’s broader strategy to diversify its reserves and reduce its dependence on the US dollar.

India, too, plays a key role in the global gold market, with significant holdings that exceed 700 tonnes. Gold is deeply embedded in Indian culture, and the country is one of the largest consumers of the precious metal, particularly in the form of jewelry.

Pakistan’s Position

Pakistan, with 64.7 tonnes of gold as of January 2025, ranks 49th on the global list. While not in the top tier of gold-holding countries, Pakistan’s gold reserves continue to grow and are a crucial part of its strategy to bolster financial security amid economic challenges.

Gold’s Growing Appeal

The surge in gold prices reflects its growing appeal as a safe haven. As geopolitical risks, inflation concerns, and economic uncertainty persist, the rally in gold prices is expected to continue. Central banks around the world are increasingly viewing gold not just as a hedge against currency fluctuations but as an important asset that strengthens national financial systems.

In conclusion, while the United States, Germany, and Italy lead the world in gold reserves, countries like China and India continue to expand their holdings, asserting their dominance in Asia. As the global economy navigates turbulence, gold’s role as a cornerstone of financial security is more significant than ever.